LIBOR Transition

By Steve Gillanders

What is LIBOR and why is it being retired?

In mid-2017 the FSA the regulatory body for the LIBOR reference rate announced that it would no longer compel banks to make submissions for its compilation at the end of December 2021.

This marked the final nail in the coffin for a much-maligned rate, tarnished in the wake of the 2008 financial crisis when it was revealed that it had been subject to widespread manipulation.

The administration of LIBOR was taken out of the hands of the British Banker’s Association in 2014 and given to the ICE Benchmark Association. LIBOR was simplified, with many tenors and half of its quoted currencies retired, leaving USD, GBP, CHF, JPY and EUR.

While these actions addressed some of the concerns about the transparency of the benchmark, its fundamental fitness for purpose had been thrown into question… and with very good justification:

In simple terms an Interbank Offer Rate represents the rate at which one bank is prepared to lend to another. It is calculated based on a small set of quotes by participants in that specific market. This bears little relation to many of the situations in which LIBOR is used

As Andrew Bailey, the Chief Executive of the FCA put it in his mid-2017 speech1:

|

The LIBOR transition had begun.

What are we transitioning to?

The LIBOR transition plans have been handled by working bodies in each of the currency zones affected. These bodies have converged replacements for LIBOR known as Risk-Free-Rates (RFRs). All five currency zones still covered by LIBOR, and three of those dropped from LIBOR in 2014 have produced an alternative to LIBOR with very similar mechanics.

- Truly Risk Free

- Based on observable market rates for a large number of executed transactions

- “Overnight” indices, set daily in arrears and compounded to cope with longer tenors.

This transition is well underway, with market participants in all the affected currency zones having rapidly increasing issuances of Fixed Income products referencing the new rates. The UK leads the way with GBP SONIA issuances in the tens of trillions of dollar equivalent notional traded in H1 2020, with the USD benchmark SOFR chasing behind with 500 billion of notional traded over the same period2.

This part of the process has happened in a timely manner that means that all the primary markets currently referencing LIBOR should be able to make a full switch to referencing RFRs before the deadline.

What this does not do is deal with the existing legacy of LIBOR related contracts whose maturity extends beyond the end of December 2021. These need a proper fallback.

Source: https://www.isda.org/2020/05/11/benchmark-reform-and-transition-from-libor/

Can we just replace LIBOR with its equivalent RFR in contracts and move on?

Unfortunately, it’s not that simple: The new RFRs are different to LIBOR in key ways

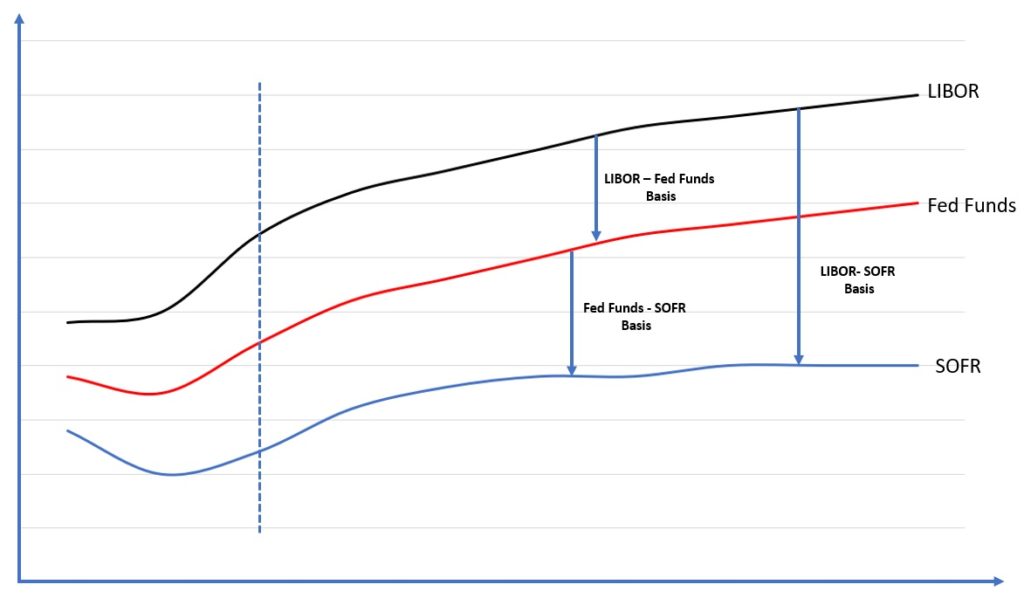

Firstly, there is a credit element. As their name suggests the RFRs are “risk-free” rates whereas LIBOR incorporates an element of credit risk from its A / AA rated contributors.

Secondly, the new RFR’s daily in arrears reset structures and overnight tenors do not match up with the typical 3m, 6m type LIBOR tenors and require compounding.

These differences mean that an RFR cannot simply be inserted into an existing LIBOR referencing contract and act as a direct replacement. There needs to be some adjustment to account for the differences highlighted above.

The International Swaps and Derivatives Association (ISDA) whose Master Agreements govern the vast majority of LIBOR traded products are in the process of finalising a consultation with market participants on the form of “adjusted RFR” calculations that will take account of these differences and allow the creation of a Fallback to LIBOR based on the new RFRs. 3

This process is expected to complete in late 2020, with the agreed fallback provisions to be incorporated into the 2006 ISDA definitions at that point

So, an “adjusted” RFR can be used to replace LIBOR and that’s it?

There is still further to go in the primary ISDA governed markets to transition… In the first half of 2020 traded notional of Interest Rate Derivatives denominated in denominated in USD, GBP, CHF, JPY and EUR referencing LIBOR (and similarly compiled indices EURIBOR and TIBOR) was $85.7 trillion and represented 59.6% of total traded notional in Interest Rate Derivatives3.

That said it is clear that the market commitment is there to achieve the transition within the deadlines, and the Adjusted RFR should allow legacy LIBOR contracts to run to the end of their life without restructuring if required (Although products traded under an older ISDA than 2006 definitions would require some attention)

However, more crucial to most organisations is that ISDA covered products are not the sole source of contractual exposures to LIBOR. You might find traces of LIBOR in non-ISDA covered contracts and agreements such as:

- Intercompany loan books and facilities

- Trade Finance agreements

- Late/Deferred payment terms in many otherwise non-financial contracts

LIBOR’s influence also goes beyond contract terms themselves: LIBOR referenced instruments are regularly used in the construction of yield curves for the purposes of projecting and discounting cashflows, determining collateral valuations and affecting margin requirements.

As such, organisations that do not have any ISDA covered instruments can still be exposed to the transition from LIBOR in less direct ways.

So, what do I need to do?

It’s almost certain you will have to to do something, but the scope and size of the challenge is highly dependent on the nature of your organisation.

The first step is to get a full picture of all of the ways in which LIBOR in its current form is embedded in your business processes; this may be in the more obvious areas such as direct ISDA contracts or in valuation methods, but it may be some other source of exposure. This discovery process will require a cross departmental effort with a senior sponsor to achieve.

The work being done on Fallback provisions means that there is no rush to the doors at the end of 2021 to have moved all contracts off a LIBOR basis, but this does not mean that there isn’t a transition to be made to move to valuations and products using RFRs directly.

At heart this is a business process, but its endpoint is likely to have systems implications for business-critical software like ETRMs, CTRMs and TMS, and this is where expert guidance from KWA can help manage the system transition.

References

1 https://www.fca.org.uk/news/speeches/the-future-of-libor

3 https://www.isda.org/2020/05/11/benchmark-reform-and-transition-from-libor/

Further Reading

FCA statement on COVID’s effect on LIBOR: https://www.fca.org.uk/news/statements/impact-coronavirus-firms-libor-transition-plans

An interesting tale of the history of LIBOR: https://www.nytimes.com/2017/03/17/business/dealbook/review-in-spider-network-an-intriguing-tale-of-complicity.html