By Richard Page

Introduced in V10, the Storage Accounting Method field was designed to provide the ability to select an alternative method for valuing Storage or Inventory balances. When the COMM-STOR instrument was enhanced with a visible Balance leg, the default was to value the inventory balance based on the price applicable to the deal’s first (or nearest) profile period. However, this did not take account of the price for forward periods where the relevant inventory balance would actually be available to withdraw. An alternative method has therefore been introduced to allow a type of FIFO valuation of the balance. This article explains its use and how to configure the field to appear on a commodity deal input screen.

Up until v12.0 the Storage Accounting Balance field was not part of the default deal layout, and hence it had to be added to an existing or new custom layout. The field was called ‘Storage Accounting Method’, although this could be renamed when added to a deal layout, e.g. Balance Method. The field has since been renamed ‘Forward Balancing Method’ and has been added to the standard deal layout (it can be found by scrolling down near to the bottom of the field list on the Primary Page). For the purpose of this article we’ll call the field Balance Method.

Hence, once you have added the field, renamed the existing one, or are using v12.0 or higher, then let’s commence by capturing a simple COMM-STOR deal and leave the Balance Method field as None.

Having set the usual Inj/Wth/Balance configuration for capturing a storage contract (assuming the Instrument sub-type “Deal Phys Balance” is selected, and Pricing Level is “Location”), set the duration on each leg to 12 months. Next enter an injection in Trading volume for Month 1 on the Volumes screen, e.g. 1,000,000. Next enter a withdrawal in Month 4 (that is less than the earlier injection), e.g. 500,000.

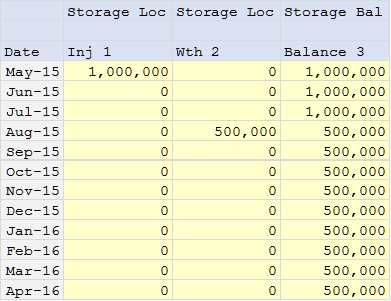

Clicking on the BAV volume type and checking the monthly volumes we would then expect to see the following:

At this point if we check the Profile on the Balance leg of the deal we can see the default treatment of the balance by Endur.

This shows that by default Endur treats the forecasted withdrawal of 500,000 in August as having an impact on the inventory today. In the above example the current Endur date is 01/05/2015, and hence the available inventory of 500,000 therms, taking into account the forecasted withdrawal, is valued at May’s price. On the deal pricer, the Injection leg will have a value based on the date of injection, and the Withdrawal a value based on the date of withdrawal. Hence, one view is that the Balance leg should therefore have a value based on when the true balance occurs. Another view is that inventory should be valued at ‘spot’, although not necessarily taking into account forecasted activity.

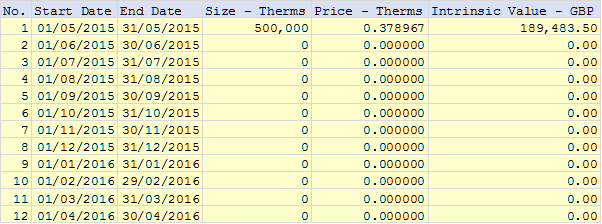

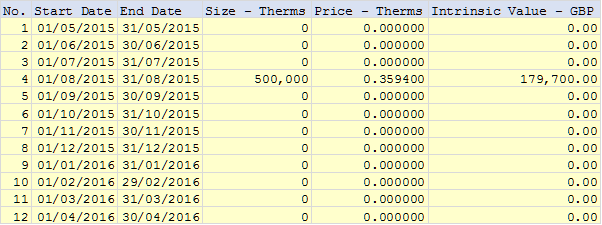

Next, we will update the Balance Method field to FIFO and reprocess the deal. This time, when we regenerate the Profile, we should see the Profile tab as follows:

This time, the profile reflects the value based on the size of the balance resulting from any relevant injection and withdrawal activity.

Using the Balance Method field provides a simple toggle between these two valuation outcomes. However, the likelihood is, where physical or virtual storage is captured in Endur, and forms part of strategic trading activity, that more sophisticated valuation mechanisms will be in place, e.g. linking to external pricing and optimisation models. In such cases, where forecasted injection and withdrawal profiles are fed back into Endur, the likelihood is that the storage contract modelled in Endur will be fully balanced over the contract year (e.g. May to Apr), and hence only zeros would be evident in the balance profile.

OpenLink have recently, primarily for bulk scheduling purposes, introduced additional selection options in the Balancing Method field, e.g. for strategy and parcel related balances.