by Israr Ahmed

In this Article we look at the academic definition of how Black Scholes is used to value options on forwards/futures – in the context of delayed payment from exercise date. We then look at how this is implemented in Endur. We also have a version of the Endur BS Formula in an online Spreadsheet format.

Academic Model

Black 76

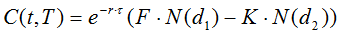

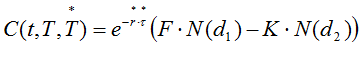

Black Scholes is used to price Spot prices. To model Future/Forward prices we assumes Futures are like a stock paying dividend q equal to r. The standard Black-Scholes with dividend collapses into:

Black 76 extension: Delayed Payment Date

In reality the actual Payment Date  generally occurs later than the Expiry Date

generally occurs later than the Expiry Date  ie

ie  .

.

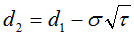

We can think of the derivative becoming a cash position (equal to it’s value) at expiration. Such a cash position does not accrue interest until payment date. Therefore this type of contract must be further discounted to take into account the delay in payment.

=  (A)

(A)

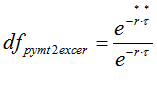

where  is the discount from the Payment Date back to the Exercise Date ie

is the discount from the Payment Date back to the Exercise Date ie

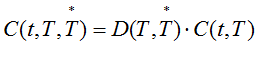

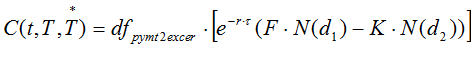

now substituting this into (A) we can also re-write

(B)

(B)

(A) and (B) are equivalent

where

is the zero rate at Expiry Date

is the zero rate at Expiry Date

is the zero rate at Payment Date

is the zero rate at Payment Date

OpenLink Model

OpenLinks B-S ( Black 76 ) Model with Delayed Payment Date

There are a number of modifications to consider:

- OpenLink sets q (the dividend) to = r (risk free rate) so that the B-S Model essentially becomes the Black 76 Model

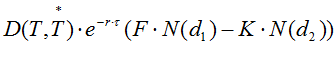

- OpenLink actually calculates the B-S (ie Black 76) value as at the Payment Date using the modified Black 76 extension shown above.

= time to Expiration (with CC Zero Rate r )

= time to Expiration (with CC Zero Rate r ) = time to Payment (with CC Zero Rate

= time to Payment (with CC Zero Rate  )

)

Given that

then

The formula can then be written in two different way – essentially exactly the same – but Formula 2 is more explicit.

Formula 1 ( as implemented by OpenLink )

Formula 2 (more explicit)

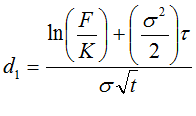

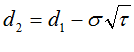

where we have the usual , time t (exercise date ) calculated;

Note: OpenLink gets the value for  {ie ‘R’ in model input screen} by recalculating the CC Zero Rate using Act/365 rather than what is on the LIBOR curve setting {ie ‘R’ in model input screen} by recalculating the CC Zero Rate using Act/365 rather than what is on the LIBOR curve setting |