By Richard Knight

Summary:

This article summarises various approaches to modelling emission certificate inventory in Endur

Introduction

Emission Trading Systems (ETS) record and track emission certificates held by participating members in registry accounts. OpenLink Endur users have implemented a variety of solutions to model registry accounts and certificate inventory in the system and the purpose of this article is to review and compare some of these approaches.

Solutions Overview

When transactions representing purchase and sales of emissions units reach delivery, qualifying certificates are transferred into the delivery recipients ETS registry account. Market participants will include the value of inventory of certificates in their trading pnl reporting and accounts.

For the purpose of this article, the ‘inventory’ requirement can be thought of in three parts: firstly how is inventory represented in the system, secondly how the delivered volumes are moved into and out of inventory and thirdly, how the inventory is valued.

1. Inventory Representation

Physical ‘Nostro’ Account – Nostro accounts can be set-up for physical delivery events, however, accounts are not linked to curves so on its own, an account will not provide a valuation, however, delivery details are maintained at deal event level, therefore the account can be used for detailed reconciliation with the ETS registry system. Note that the accounts can be setup

- ENGY-PHY-INV – Instrument in the ComFwd toolset. Provides a repository for commodity deliveries, linked to a valuation curve. Maintains an aggregated inventory position.

- COMM-STOR – Instrument in the Commodity toolset designed primarily to support physical gas storage. Inventory Credits ( Injections) and Debits (Withdrawals) are captured on separate deal sides with a third balance deal side made of the volumes on the other sides. Each deal side can be independently linked to a price curve and provides some flexibility for valuation. Maintains an aggregated inventory position as well as record of net daily credit and debit movements.

- COMM-INV – A relatively new instrument in the Commodity toolset (CTS) which is the CTS equivalent of the ComFwd ENGY-PHY-INV. The COMM-INV has just one physical deal side and provides a repository for commodity deliveries, linked to a valuation curve. Maintains an aggregated inventory position as well as record of net daily movement.

2. Volume Transfer Mechanisms

The following Endur solutions are typically encountered in Emission solutions and will be reviewed:

- Nostro Account + Physical Settlement Rules

- Custom Transfer Process

- cMotion

2.1 ComFwd Inventory + Physical Settlement Rules

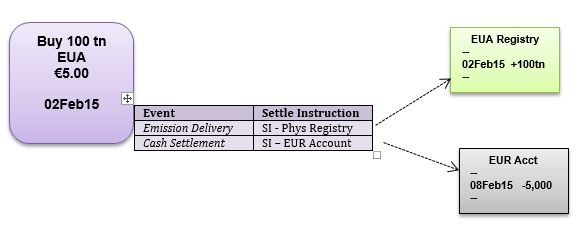

Users will be familiar with cash settlement events on transactions, linking the event (payment) to a bank (nostro) account via settlement instructions (SI) attached to the event.

The commodity (emission) delivery event on transactions can have SI linked to them in exactly the same way as they are linked for cash settlement events.

With an SI attached, the delivery event is linked to a physical nostro account which can be viewed in the physical equivalent of the Account Balances viewer.

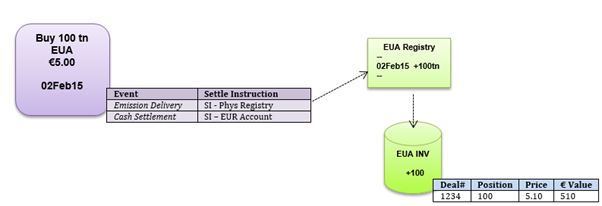

So when the events are processed, viewing the EUA Registry (nostro) account we can see a credit of 100tn on 02Feb15. But the position is captured in an account how to value this position? This is where the ComFwd inventory instrument comes in. A ‘warehouse’ instrument can be directly linked to a physical account so that delivery events processed to the account are also transferred to the ComFwd inventory which will then value the position at the spot price ( achieved by running standard eod plugin)

Note: Only ComFwd inventory instruments can be directly linked to accounts. This approach was often implemented in early versions of Endur though is no longer OpenLink’s ‘standard solutions’ approach, which instead uses a plugin ( custom transfer process ) to transfer positions to COMM-STOR inventory.

2.2 Custom Transfer Process

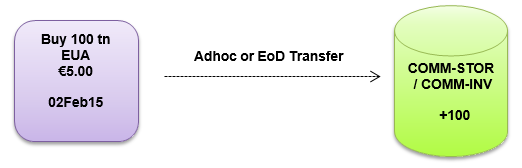

As the name suggests, the most commonly implemented solution is bespoke code, in its simplest form, a task, typically run during end-of-day, that sweeps deliveries into either COMM-INV or COMM-STOR inventory with more complex versions that calculate and set a FIFO price for the inventory delivery.

This is the transfer method, together with COMM-STOR, deployed in Openlink’s standard solution for Emissions.

2.3 cMotion

OpenLink’s bulk commodity scheduling tool ‘cMotion’ can be used to achieve the transfer of positions from physical deal to inventory (COMM-STOR only, not COMM-INV). It is a licensed feature and provides much richer functionality than is generally required for emissions, so tends to be used for emissions only where it is also deployed for other bulk logistics requirements: Crude, Coal, LNG etc.

Delivery id’s maintain a direct link between the physical deal and each transfer to inventory and various views are available within cMotion desktop for both the inventory position and previous transfers/deliveries so the information can be used to perform a detailed reconciliation with the ETS registry. Automating the cMotion ‘nomination’ transfers can often require custom code to be developed ( note at the time of writing the automation api’s do not support user defined instrument types)

3. Inventory Valuation

Depending on existing middle office and accounting practices, different methods of calculating inventory valuation can be required. For example, markets for certain types of emission units might be viewed as liquid and others as illiquid requiring different valuation and accounting treatments. Three common valuation methods are these:

- Spot

- Cost FIFO

- Spot FIFO

The following sections outline the calculation methodology of each one. There can be several variations on FIFO methods so the ones presented here are indicative of the general approach.

Note: The following examples assume transactions, prices and inventory are all in a common currency. FX conversions would be required if the assumption is false.

3.1 Spot Valuation

This is the simplest of the valuation methods and is just the volume of inventory held * the current spot price. All three of the inventory instruments discussed previously can provide this valuation.

3.2 Cost FIFO Valuation

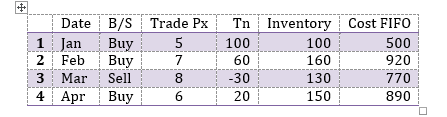

This method uses trade prices of purchases to determine valuation. The current inventory amount is valued using the most recent purchase prices. The example below shows a series of transactions and the calculation that should result.

- All of the 100Tn inventory can be attributed to the single purchase in Jan so valuation is: 100 * 5 = 500.

- An additional 60 @ 7 is purchased and inventory is now 160. Working back through the purchases until all 160Tn has been valued: 60 @ 7 + 100 @ 5 = 920.

- 30 Tn is sold @ 8 reducing inventory to 130. Working back through the purchases: 60 @ 7 (420) + remaining 70 @ 5 (350) = 770.

- Another purchase of 20Tn @ 6 so inventory is 150 and valued as: 20 @ 6 (120), 60 @ 7 (420) + 70 @ 5 (350) = 890

None of the inventory instruments discussed previously provide this valuation as standard, though the calculation can be embedded in the custom transfer process and the Cost FIFO unit price set on the inventory ( COMM-STOR only). Alternatively the calculation can be embedded in a custom pnl result to provide the choice of reporting either the Spot or FIFO valuation.

3.2 Spot FIFO Valuation

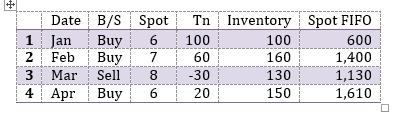

Whereas Cost FIFO uses the trade price of deals, Spot FIFO uses the spot price on the delivery date.

- All 100Tn inventory is attributed to the single Jan purchase so valuation is: 100 * 6 = 600.

- An additional 60 @ 7 is purchased, inventory is now 160. Working back through the purchases and prevailing spot price, inventory value is: 60 @ 7 + 100 @ 6 = 1,020.

- 30 Tn is sold @ 8 reducing inventory to 120. Working back through the purchases: 60 @ 7 (420) + remaining 70 @ 6 (420) = 840

- Another purchase of 20Tn @ 6 so inventory is 150 and valued as: 20 @ 6 (120) + 60 @ 7 (420) + 70 @ 6 (420) = 960

None of the inventory instruments discussed previously provide this valuation as standard, though the calculation can be embedded in the custom transfer process and the Cost FIFO unit price set on the inventory ( COMM-STOR only). Alternatively the calculation can be embedded in a custom pnl result to provide the choice of reporting either the Spot or FIFO valuation.

SUMMARY

The following table offers a comparison of the different inventory representations and transfer methods that have been discussed:

Inventory Type | Transfer Mechanism | Valuation | Comment |

Physical’Nostro’Acct | • Settlement Instructions | None | Models registry account and can be used to reconcile line items in the account |

ENGY-PHY-INV | • Standard Process | • Spot Valuation

• Others may require customisation | Reliable though limited solution that can be implemented without customisation |

COMM-STOR | • Manual • Custom Process • cMotion | OL standard solution Provides the most flexibility. | |

COMM-INV | • Manual • Custom Process | Alternative to COMM-STOR though with less flexible valuation options |