by Israr Ahmed

Let’s say we are a USD reporting company trading EUR denominated Oil products. Oil is quoted in USD so there is a FX risk.

1. Terminology

= spot fx rate

= spot fx rate

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

Floating Index is a BRENT(USD) index converted to EUR value using forward rate ;

Fixed payment in EUR is just that ;

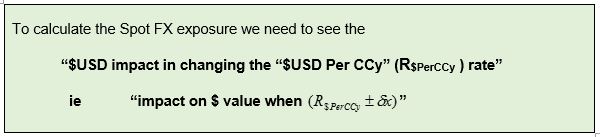

2. Definitions of Spot FX Exposure

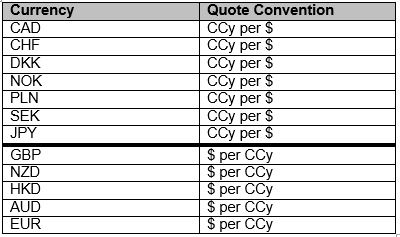

Note that some currencies are quoted as USD per CCy and some quoted as CCy per USD.

2.1 For “$ per CCy” quoted currencies

Rate is already denoted by R$PerCCy.

2.2 For “Ccy per $” quoted currencies

Rate is denoted by RCcyPer$

Note that RCcyPer$ = 1 / R$PerCCy

Simple algebra shows

so in this case

Let’s say the SPOT_PRICE curve is setup via use of grid point formula so that the Output rate is always in terms of Currency/USD (we divide by this rate to convert from Ccy to USD)

This allows the forward curves to be generically written as

Endur itself knows which way the Input rate FX rate is around as this is stored in the “currency” table.

3. What is our spot FX exposure for EUR denominated Oil Swaps ?

3.1 Valuation

As we a representing a USD Company, we value the EUR denominated Oil swap in USD :

now given that  this reduces the above to :

this reduces the above to :

3.2 FX Exposure on Unfixed Part Of Linear Deal = 0

= 0

= 0

(assuming no relationship between  and the Libor curves)

and the Libor curves)

3.3 FX Exposure on Fixed Part Of Linear Deal = Currency Value (discounted)

= XEUR

= XEUR