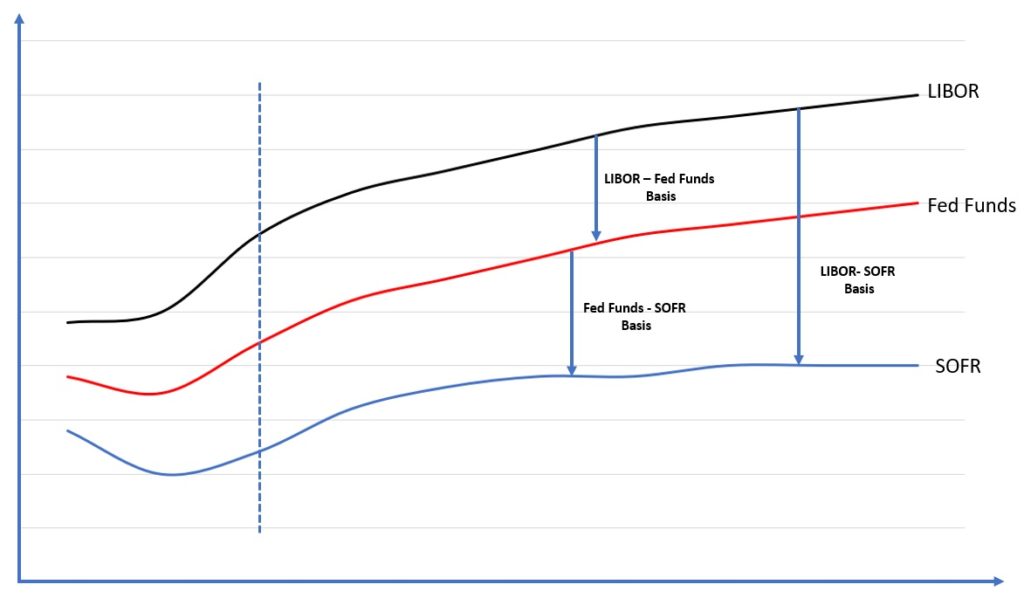

LIBOR Transition

KWA’s Stephen Gillanders insightful article details why and how LIBOR is being replaced and what organisations need to do about the transition from LIBOR to Risk Free Rates in 2021. This has implications for business-critical software like ETRMs, CTRMs and TMS, and is where expert guidance from KWA can help manage the system transition.