DevOps and ETRM: A Strategic Approach for Driving Value

If you are implementing or upgrading your Energy Trading & Risk Management (ETRM) system, now is the time to integrate

From our global offices in Europe, the Americas, India, and Asia-Pacific we offer a comprehensive range of consulting services for trade lifecycle management to clients involved in energy, commodities, shipping, treasury, central banking, capital markets and asset/investment management, delivered by the most experienced and well-regarded business and technical consultants in the industry, enabling clients to derive enhanced business value from their system investments

KWA is an award winning company, in Capital Markets Technology Solutions, and top ranking in the prestigious Energy Risk Software Rankings 2023 following our wins in 2022, 2021, 2020, 2019, and 2018.

Covering a range of topics, our articles are written by subject matter experts providing insight into system implementations and all areas of functionality

If you are implementing or upgrading your Energy Trading & Risk Management (ETRM) system, now is the time to integrate

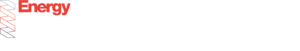

KWA’s Stephen Gillanders insightful article details why and how LIBOR is being replaced and what organisations need to do about the transition from LIBOR to Risk Free Rates in 2021. This has implications for business-critical software like ETRMs, CTRMs and TMS, and is where expert guidance from KWA can help manage the system transition.

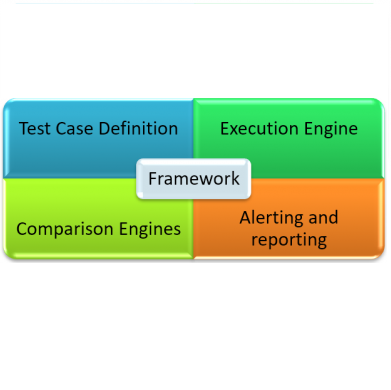

The benefits of automation are widely applicable and proven. At the highest level it comes down to one fundamental advantage: efficiency. As companies strive to become more efficient, automation – wherever and whenever possible – is the clear answer.

If you are implementing or upgrading your Energy Trading & Risk Management (ETRM) system, now is the time to integrate

In any organisation, core values serve as guiding principles. At KWA Analytics, our values aren’t just words; they are the

Orchestrade and KWA Analytics, an award-winning, capital and energy market system specialist consulting group, have announced a strategic partnership to

We have unrivalled expertise in successful C/ETRM and TMS implementations, and digital transformation projects, as well as defining market solutions that have become system industry standards. We have a proven track record of successful deliveries at greenfield projects and at existing clients.

Copyright 2022 KWA Analytics

Openlink®, Endur®, Findur®, and the Openlink logo are trademarks, service marks or registered trademarks of Openlink Financial LLC.

KWA Analytics and Openlink Financial LLC are unaffiliated companies.